Realty sector set to grow

The housing sector, which underwent a prolonged slowdown and a liquidity crisis, is slowly seeing renewed investor interest, particularly for projects by developers who are known for efficient execution and delivery

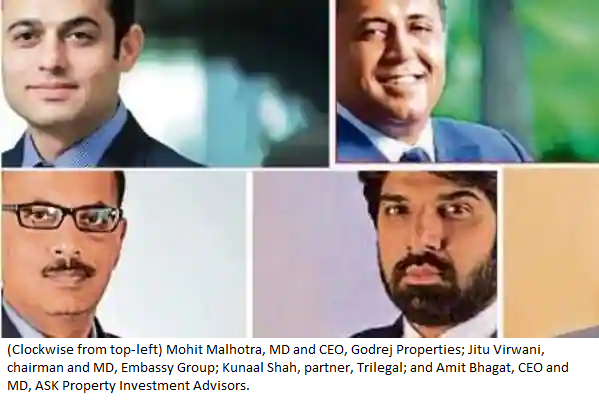

Mohit Malhotra, managing director and CEO, Godrej Properties Ltd

There was a major revival in the residential sector in 2020-21 despite the pandemic last year. Real estate prices are at an all-time low and affordability is at a high. Buyers understood the importance of a well-designed home. Currently, it’s a huge crisis and at an alarming level. There will be a disruption in the June quarter, but the long-term outlook is healthy.

Jitu Virwani, chairman and managing director, Embassy Group

The first wave of the pandemic last year was harsh, particularly as the national lockdown halted construction, prompted large scale labour migration and created unprecedented uncertainty. However, from September-October onwards, the realty sector made a strong recovery especially in the residential sector until the onset of the second wave this year. Jitu Virwani, chairman and managing director, Embassy Group said good quality homes, which are ready to deliver, will continue to see high demand.

Nipun Sahni, partner-real estate, Apollo Global Management

On the commercial office front, we expect the sector to do well in the long-term despite the work-from-home phenomenon. Occupiers are currently in decision-making mode in terms of workspaces, where some may give up space, but others may ramp up. Once everyone gets the second vaccine shot, companies will bring back employees to offices latest by the year-end," said Virwani. The housing sector, which underwent a prolonged slowdown and a liquidity crisis, is slowly seeing renewed investor interest, particularly for projects by developers who are known for efficient execution and delivery. “We did 26 transactions in the last 12 months, and it was a busy year for us with a lot of opportunities. The domestic market is starved of capital with NBFCs pulling back and banks being wary. Most of the capital coming in is through the offshore route.

Amit Bhagat, managing director and CEO, ASK Property Investment Advisors

The firm deployed its maximum capital last year. “The opportunity for investors today is lucrative and counter-cyclical if one understands the risk metrics. We will continue to look at investment opportunities and beyond the second wave, we are bullish about the residential space. Until the second wave, homes across the spectrum including luxury and second homes, plotted sales did well," Bhagat said.

Kunaal Shah, partner, Trilegal

Kunaal Shah, partner, Trilegal said the company had “the busiest year in terms of foreign investments and transaction flow last year." “For any investor with deep pockets, it’s a time of great opportunity and for the end-customer, it’s a good time to buy," Shah said.

M. Murali, chairman and MD, Shriram Properties Pvt. Ltd

Investor faith was demonstrated in the residential sector with the much-awaited public listing of Macrotech Developers Ltd, which operates under the ‘Lodha’ brand. “Housing demand has been very strong and that will not change in the long-term. The June quarter could take a hit for developers but like last year, the recovery in the third and fourth quarters is expected to be repeated in 2021-22 as well," said M. Murali, chairman and MD, Shriram Properties Pvt. Ltd, which is also looking at initial public offering.

Shobhit Agarwal, managing director and CEO, Anarock Capital

Shobhit Agarwal, managing director and CEO, Anarock Capital said globally, residential and logistics are the two sectors that have done extremely well through the pandemic.